Optimizing India’s gas market through tariffs

Pipelines are a critical piece of infrastructure for delivering gas to various regions of India. What happens when pipelines are unable to provide affordable gas, thereby not reaching their intended utilization levels? What will the future of India’s gas market look like?

The answer may lie with tariffs design.

Current pipelines and tariff values

Gas markets in India started to evolve from the northwestern part of the country, aided by the fast development of infrastructure to move gas from supply sources to demand centers. Gas pipelines like Hazira-Vijaypur-Jagdishpur (HVJ), Dahej-Uran-Panvel-Dhabhol (DUPL-DPPL), and the local gas grid of Gujarat helped with the fast conversion of demand to gas.

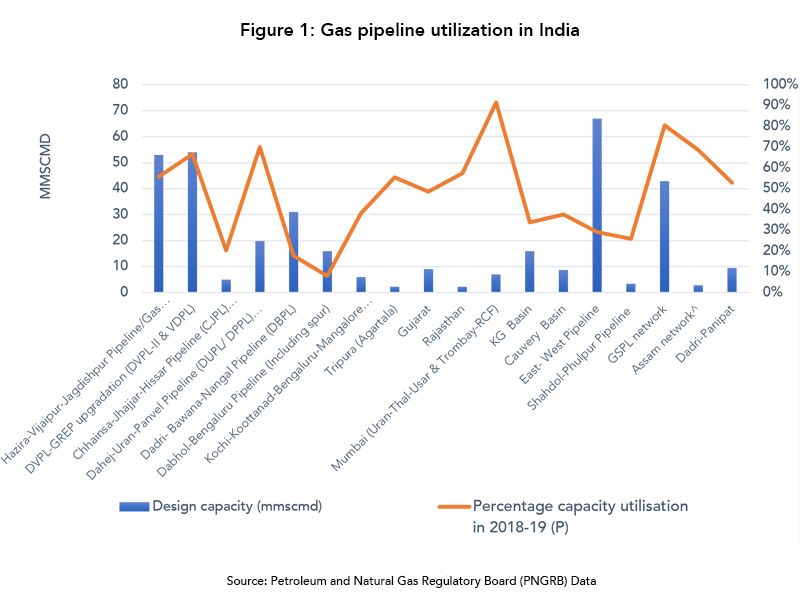

Based on the success of these gas pipelines, India commissioned other pipelines across the country. Yet, only the gas pipeline in the northwestern part of India has been able to maintain high utilization levels (see Figure 1).

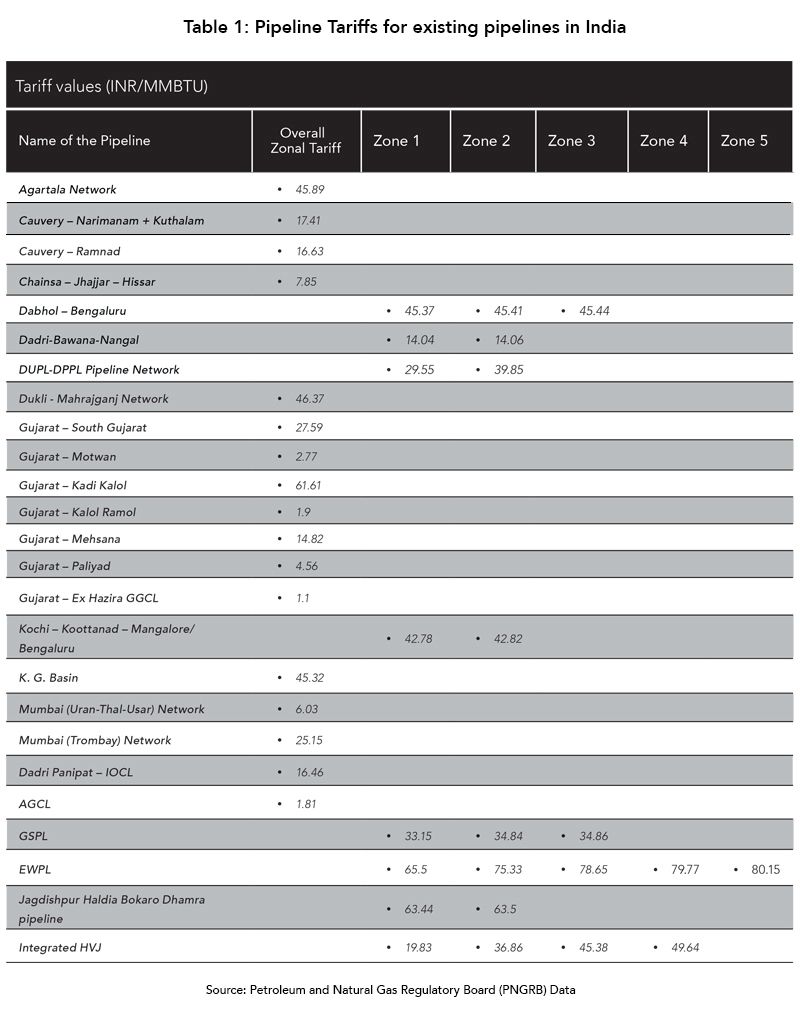

Nearly 70% to 80% of the gas transported within India travels from one of the northwestern pipelines whose pipeline tariff is low—an essential cost component of the delivered gas price. Tariffs within pipelines consists of zonal tariffs where each zone corresponds to 300km. Under the current structure, the pipeline tariffs of the northwestern region range between $0.25 and $0.60 per MMBtu. Pipelines in the southern and eastern region, however, have zonal tariffs in the range of $0.60 to $1.00 per MMBtu.

The Indian gas market is a highly price-sensitive market; even variations in the gas prices by $0.20 to $0.30 per MMBtu have the ability to change the market complexion. Additionally, the pipeline tariff structure is additive in nature, so if India constructs more pipelines, the consumer will have to pay a tariff for two to three pipelines, which could increase the transportation cost by $0.50 to $1.00 per MMBtu.

This could then raise questions over the viability of the gas market in the eastern and southern parts of the country. Such a scenario could affect the growth plans of the Indian government to increase the overall share of gas to 15%.

Changing pipeline costs

To eradicate these scenarios, the Petroleum and Natural Gas Regulatory Board (PNGRB) had been mulling over the rationalization of the gas pipeline tariff. Now, they have come out with guidelines to bring a unified tariff policy. Under this policy, India will divide the gas pipeline tariff into two zonal tariffs, with Zone 1 tariff being 40% of Zone 2 tariff. This would apply to all gas pipelines of GAIL, Gujarat State Petronet Limited (GSPL) network, and the east-west pipeline of Pipeline Infrastructure Limited (PIL).

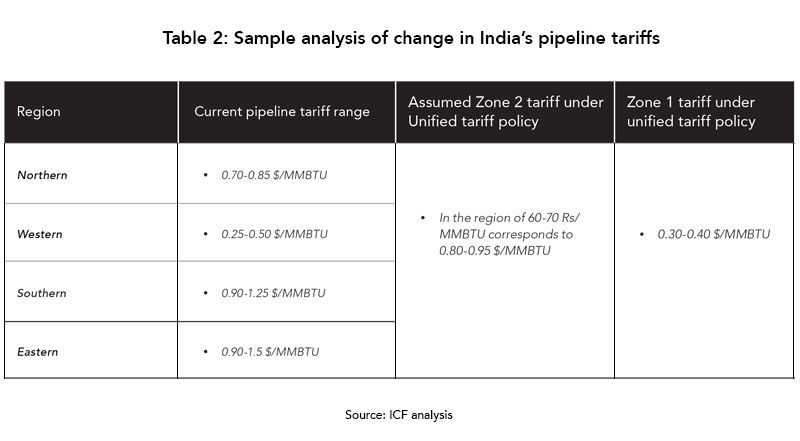

This policy could help achieve a lower pipeline tariff to deliver natural gas in southern and eastern gas markets (see Table 2).

The southern and eastern regions are likely to get sufficient benefits from the tariff change, as most customers would lie in Zone 1 of the LNG terminals and domestic supply sources. For the northern region, the customers would lie in Zone 2. Therefore, customers connected to HVJ in Gujarat, Rajasthan, and Western UP anticipate a slight increase from the existing tariff. For customers in Punjab, Haryana, and Eastern UP, the benefit will come from lower tariffs. In Gujarat, the customers will lie in Zone 1 but the new tariff will be higher by 20% to 30% in comparison to the existing tariff.

Identifying the most optimum Zone 2 tariff under a unified tariff scheme will be key, as it will have a major impact on the gas demand of different regions of India. Southern and eastern gas markets would benefit the most, as gas consumption levels could increase to the tune of 50 to 60 Mmscmd in the next five to seven years. Demand increase in the gas industry might be heavily dependent on the growth of City Gas Distribution (CGD) network in areas lying in the vicinity of the pipeline. CGD markets offer high potential for demand as the sectors target high volume segments like transport and industrial sectors. While the transport sector falls under allocated gas, tariff regime can support the CGD entities to procure competitive gas (industrial and commercial segment) as they will have uniform options to secure re-gasified liquified natural gas (RLNG) from the gas hubs via exchange. It is expected that share of CGD of the increased gas demand could be in the range of 40-50% in the southern and eastern regions.

Formulation of the new tariff scheme might turn out to be a crucial component in the faster development of pipelines which would provide a boost to the CGD networks that are being planned in areas where pipeline does not exist.

However, this will depend on how the new pipeline tariff scheme is implemented along with development of LNG terminals in the south and east. In addition to the demand increase, the unified tariff might lead to more trading on the gas exchange, due to simplified gas price calculation for end consumers.

While there continue to be variables surrounding the future of gas demand in India, one thing is relatively certain: tariffs—existing tariffs, new tariffs—will play an important role in the country’s energy future.