New York’s ambitious energy storage goals provide incentives and opportunities for developers

About two years ago, New York State doubled its battery storage target to 6 GW by 2030, as it is on a trajectory to infuse intermittent renewables in its electric grid while keeping the lights on. Only about 5% of the goal has been built by the end of 2023, leaving the future of storage deployment in New York uncertain.

In the post-pandemic era, construction costs of batteries increased about 20%-30% according to battery storage developers, making it more difficult for developers to secure project financing. To meet the ambitious goal of 6 GW, the New York State Energy Research and Development Authority (NYSERDA), in collaboration with the New York Department of Public Service (DPS), recommended a solution that has been tested successfully with renewables: the index storage credit (ISC) structure.

What is the Index Storage Credit (ISC)?

The ISC structure focuses on lifting barriers and mitigating risks to storage deployment amid recent supply chain challenges and escalating battery component costs. Under this approach, storage developers would submit a “strike” price that captures the revenue requirement per megawatt-hour in their proposal.

If their projects are selected, NYSERDA will make monthly payments to developers over the course of 15 years, following the revenue variability in the wholesale commodity markets and bridging a potential gap between commercial revenue and the project’s strike price. Through this framework, NYSERDA aims to incentivize storage projects only for the days they are operational, regardless of their performance (i.e., round-trip efficiency).

For developers, it is crucial to determine the proper all-in strike price based on the project location and evolving market conditions. Ideally, the strike price should be high enough so that NYSERDA can provide the required support for the project to be profitable while also remaining low enough to be competitive with other bids.

Developers should also fully comprehend the opportunities and risks of the ISC framework to position themselves strategically compared to their competitors. One such risk occurs with the Reference Energy Arbitrage Price (REAP) metric used in the ISC framework, which is calculated for 4-hour storage resources from the spread between the four highest and four lowest day-ahead (DA) power prices.

Battery operators may not be able to fully realize the estimated REAP by operating in the DA market due to battery operating limitations and unforeseen outages. However, with the use of advanced energy storage optimization software, developers may not only improve their asset’s performance in the DA market, but even exceed the REAP through participation in real-time (RT) and/or ancillary services markets.

Since energy arbitrage is more likely to be at a premium in the RT market compared to the DA market, the RT market will be more attractive to short-duration batteries. The 5-minute granularity of the RT market also provides battery operators the ability to update sales and purchase offers throughout the day rather than having to set them ahead of time. In this manner, operators can capitalize on large RT price swings caused by a sudden weather change or an unexpected system outage.

Historically, the RT market has been consistently more volatile than the DA market, offering higher potential for profits. Over the past four years, price volatility in Zone J (NYC) observed in the RT market was double that of the DA market.

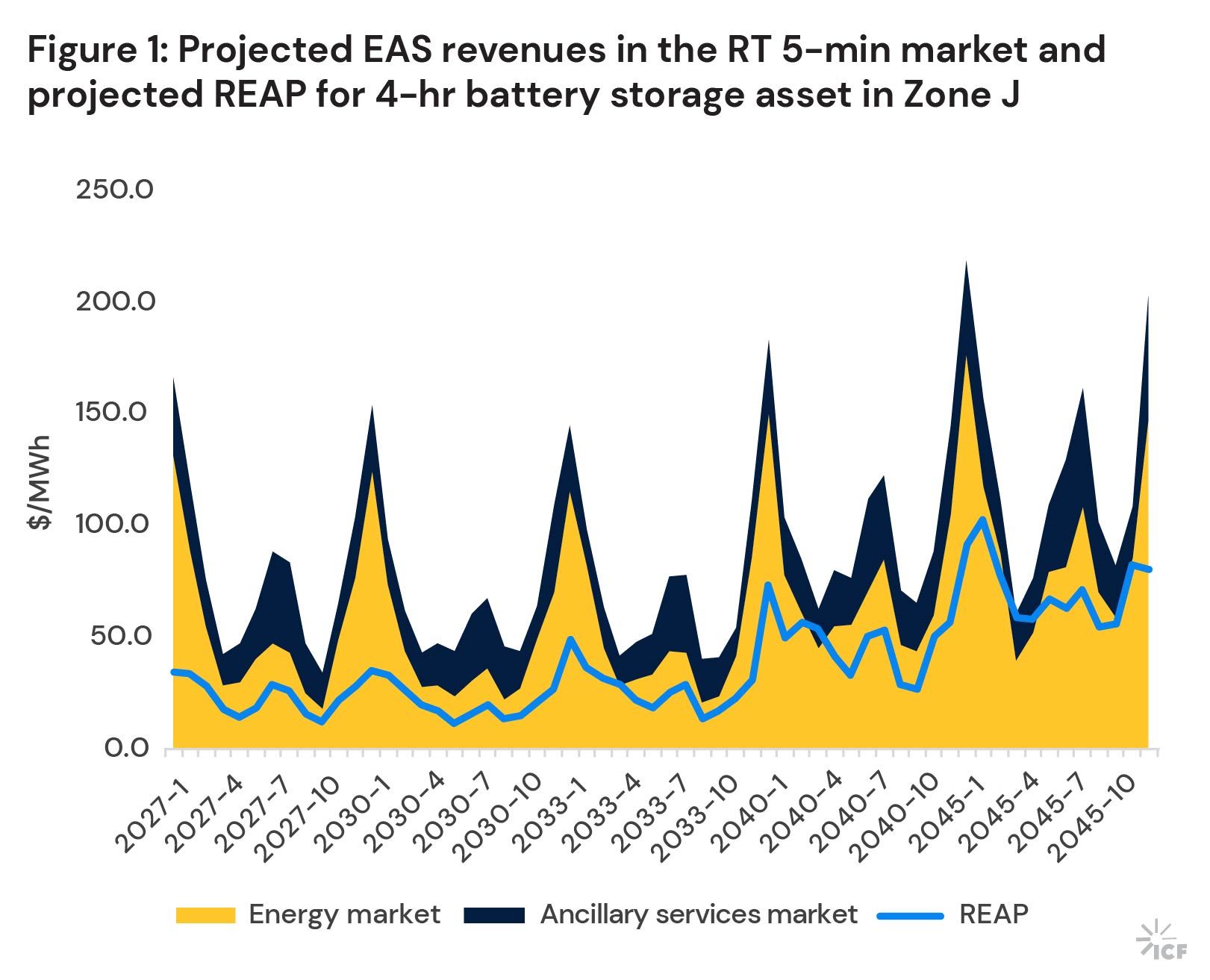

Based on our projections in Figure 1, monthly energy and ancillary services (EAS) revenues in the RT market for 4-hr battery storage are expected to outperform the DA-based REAP. (Modeling note: We derive 5-min RT price projections using stochastic modeling based on historical prices, projected volatility from the supply mix evolution, and our DA market price forecast, assuming the state’s storage target is fulfilled. To develop storage dispatch projections and estimate EAS revenues, we deploy our proprietary ES-Optima model using the 5-min projected RT prices as an input and assuming one cycle per day and a round-trip efficiency of 0.85).

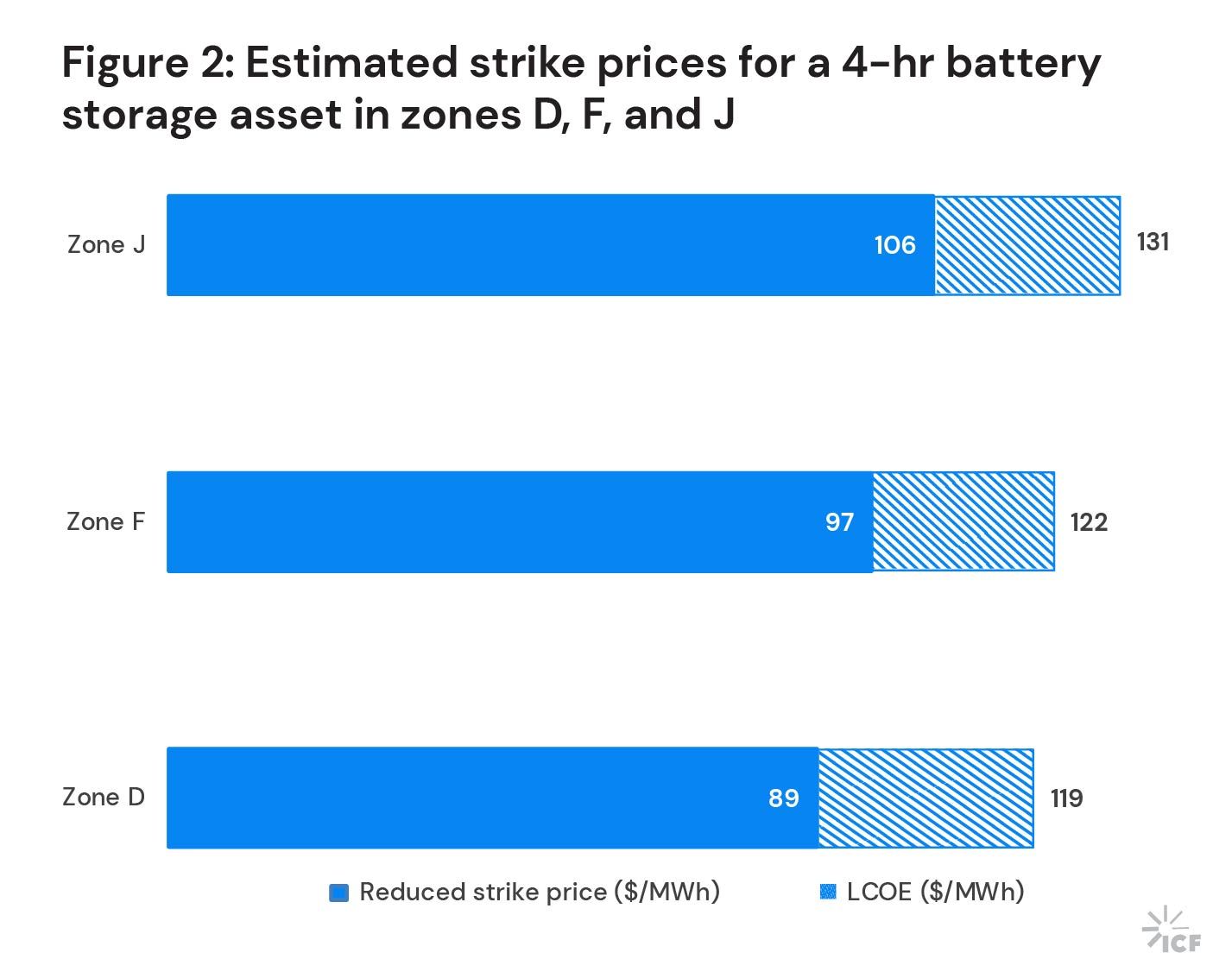

Since battery developers with the proper bidding behavior in the RT market can exceed the REAP, they can leverage the resulting difference between the actual revenue and REAP projections to reduce their all-in strike price and form a more competitive bid while still meeting their revenue requirement. Based on 2022 NREL ATB data and our internal financial assumptions, the revenue requirement for a 4-hr battery storage asset coming online in 2030 in Zone J (NYC) is expected to be ~$131/MWh.

After aggregating the difference between the projected zonal RT 5-min EAS margins for this 4-hr battery storage asset and the REAP on an annual basis, we forecasted the potential premium in RT margins over the duration of the program (2030-2044). Due to this projected additional revenue, battery developers may be able to discount their initial bid by ~20% and still maintain the financial viability of their projects in Zone J.

Likewise, developers in Zones F and D may be able to reduce their bids by around 21% and 25%, respectively (Figure 2). Lower bids may help reduce the cost of the program and eventually minimize the economic burden on ratepayers, contributing to the success of this framework. However, delays in renewable deployment could reduce projected volatility and limit the expected RT premium, shrinking the developers’ potential bid discount.

The expected premium in RT margins could also be marginally affected by a resource’s point of interconnection. Resources interconnected at nodes with more volatile prices compared to the respective zones could bid at a further discount to the strike prices mentioned above. However, nodes with less volatile prices might see slightly higher strike prices due to the reduced potential for energy arbitrage at the nodal vs. zonal level.

The ISC is intended to incentivize battery storage development to meet state targets when storage resources would not otherwise be economical to build, with the economics primarily depending on the resource’s cost of new entry (CONE), a function of capital costs and assumed capital structures.

Here are three reasons developers need the ISC to help the state reach its storage target:

- Without the ISC, capacity prices in NYISO are expected to remain at levels below the projected 4-hr energy storage net CONE (gross CONE net of expected EAS revenues) until 2030 due to limited growth in New York’s peak demand during that time. Thus, market economics for new 4-hour battery storage systems will be inadequate for timely storage deployment and delay New York’s achievement of its 2030 target of installing 6 GW of storage.

- The ISC will act as an incentive program to bridge the gap between market revenues and gross CONE. This will be necessary to drive investment in battery storage systems and enable the state to meet its 2030 storage goal.

- The ISC is projected to only be required until the achievement of the state’s 2030 target. ICF expects that rising demand due to electrification post-2030 will drive up energy and capacity prices, and spur entry of storage assets even without state support.

Ultimately, the new ISC framework incentivizes developers to build future energy storage while, at the same time, securing a more resilient future for New York communities.