Is future natural gas demand growth a mirage?

The future for demand growth is promising. That is a key conclusion from ICF’s second quarter Natural Gas Market Outlook. Over the next decade the future growth of natural gas demand looks to be dominated by the following two key sectors:

- Growth from gas-fired power generation, and

- Liquefied Natural Gas (LNG) exports.

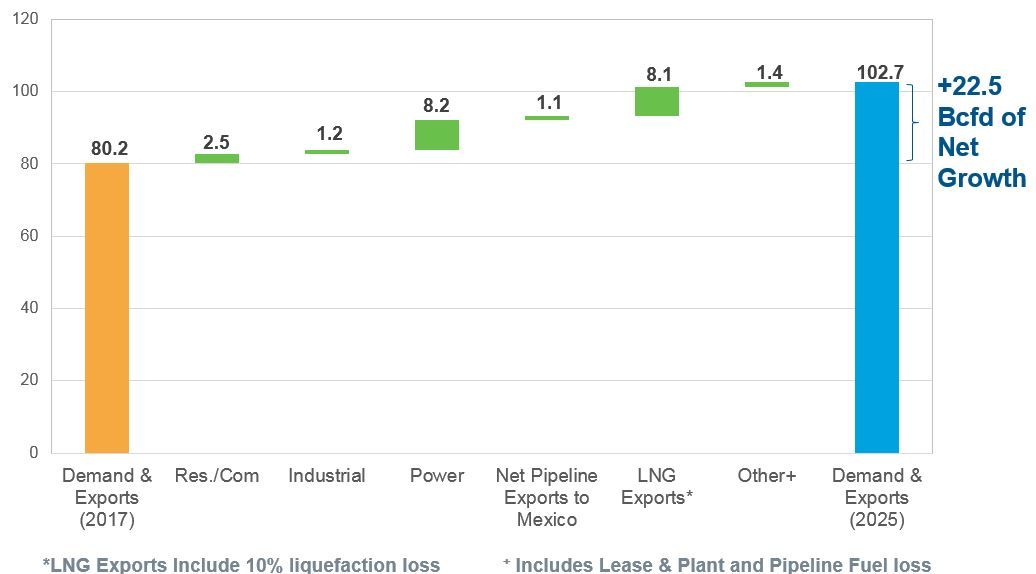

From these two sectors alone, ICF is projecting 22.5 Bcfd of gas demand growth by 2025, representing a 30 percent increase over today’s levels (Figure 1).

That said, ICF believes that there are emerging signs that there will be unexpected challenges that may keep the expected growth from fully materializing. We’ve seen rapid and major transformations over the past two decades in the energy industry. Natural gas is not immune to intervening trends—and getting too comfortable with the current forecast can be just as threatening as a competitor. We need to explore several key emerging hurdles that may stunt the projected demand growth for North American natural gas markets while evaluating ICF’s current gas market outlook.

Projected Drivers of Demand

Demand growth will be led by increases from power generation, which we are projecting to grow by 8.2 Bcfd, or 35% of the total projected growth. Projected demand growth from LNG exports is a close second, adding 8.1 Bcfd of natural gas demand over the same time. Growth in Mexican exports, which is also driven by increasing natural gas usage in the power generation, is expected to reach 1.1 Bcfd by 2025.

Figure 1: Change in North American Gas Use (Billion Cubic Feet per Day, 2017-2025)

As energy markets become more complex, industry leaders are embracing an integrated approach to an increasingly globalized market. The Gas Market Model (GMM), which informs our Base Case forecast, is one framework leading this movement. Operated on an integrated basis with ICF’s broader tool set (which includes the Integrated Planning Model (IPM) for power sector modeling), the GMM provides an integrated assessment of supply, demand, and forward prices (including basis) throughout North America.

Source: ICF's Gas Market Model (GMM)

Power Generation Growth, Seemingly Robust but Definitely Uncertain

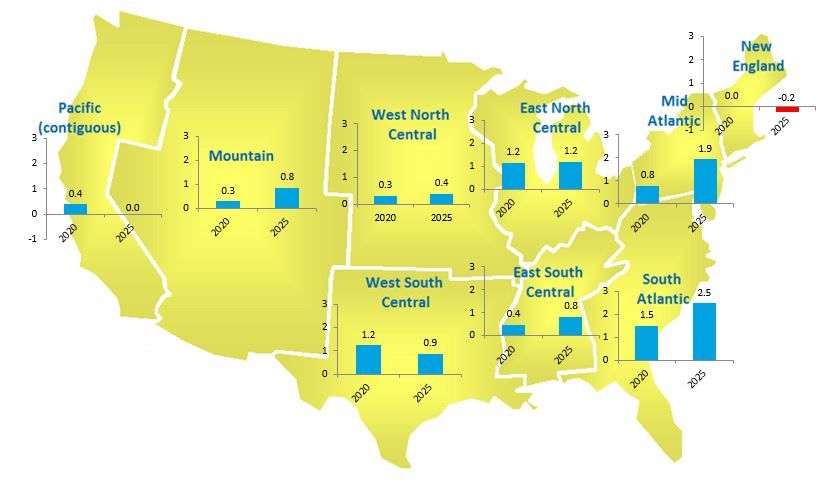

Growth in power generation gas demand is expected in all regions of the United States, with the exception of New England (Figure 2). This is on par with sector trends since 2008, where the US has added 60 GWs of new or repowered gas-fired generation, largely at the expense of coal.

Developers have announced plans for an additional 70 GWs of new or converted gas-fired generation units, with roughly half of these units under construction or having received regulatory approvals. Assuming all of this new capacity is needed and the projects are completed, an additional 3 Bcfd of incremental demand above ICF’s Base Case forecasts would be added.

Figure 2: Forecasted Regional Power Generation Gas Demand Growth from 2017 (Billion Cubic Feet per Day)

Source: ICF’s Gas Market Model (GMM)

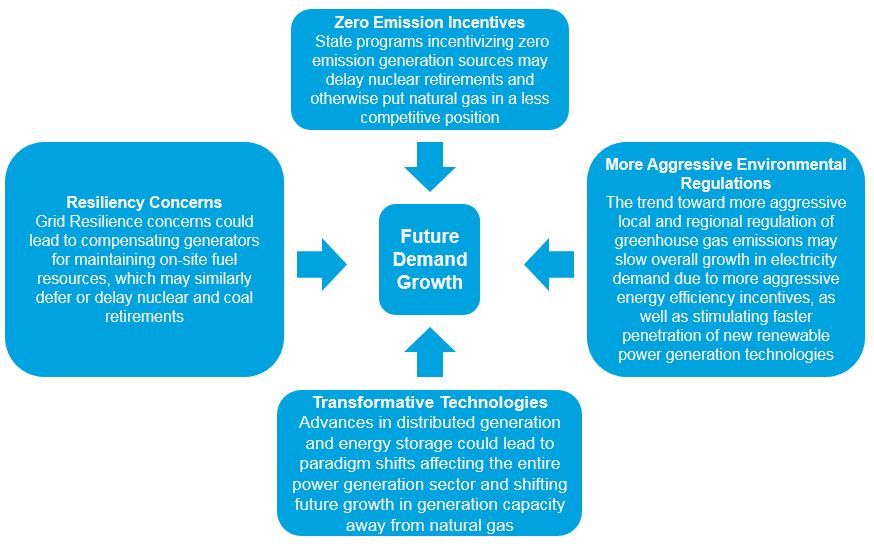

Here’s where it gets tricky, with several trends that could significantly moderate our forecasted demand growth from the power sector (Figure 3).

We go into further detail on these trends in our upcoming webinar 3 Factors that Will Guide the Way Forward for Natural Gas.

Strong LNG Growth Relies on External Factors

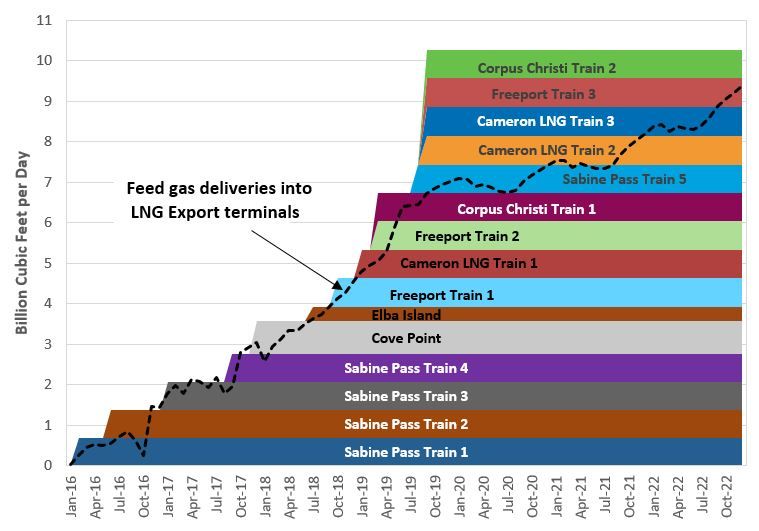

LNG exports similarly promise a bright future like the power sector, but dependence on the world staying on its current trajectory means there are things that can affect this projection. In 2017 alone, US exports of LNG doubled to roughly 3 Bcfd. Existing and planned additions to liquefaction capacity should increase the export capabilities to over 10 Bcfd by as early as 2020 (Figure 3).

Figure 3: U.S. LNG Export Capacity Currently Operational or Under Construction (Billion Cubic Feet per Day)

Source: ICF’s Gas Market Model (GMM)

While we do not believe that all of this capacity will be fully utilized in the near term, by 2025 we anticipate sufficient growth to stimulate additional export capacity requirements. But risks to LNG growth also exist, including:

- Low Oil Prices – Moderated world oil prices reduce demand for LNG, as well as the incentives for making large capital investments in new LNG liquefaction capacity.

- Global Energy Demand – LNG growth is particularly sensitive to growth in Asian energy demand and, consequently, the region’s overall growth rates and fuel-sourcing decisions.

- Global Efficiency, Environmental, and Renewable Trends – While natural gas generally represents an economic, and environmentally net beneficial option, growing global initiatives for zero emission technologies and renewable energy sources could dampen overall gas demand.

Nationally, Policy Driven Electrification is the Wild Card

Electrification of energy demand—including conversion of gas-fired technologies to electric alternatives and rapid penetration of electric vehicles—has growing support. Some advocates see this as the fastest and most realistic means of achieving ambitious emission-reduction goals (e.g. the various initiatives to achieve 80% reduction below 1990 levels by 2050).

While electrification implies a reduction in gas demand at the end-use level, the net impact is less clear and depends on whether the incremental power sector load due to electrification is met by natural gas or renewables or other alternatives.

If end-use technologies are replaced by electric technologies supported by gas-fired generation, the net effect on overall gas demand may be modest, if not even positive. Under certain circumstances, ICF is projecting that electrification of current end-use natural gas demand could actually lead to an increase in total natural gas demand.

Rapidly Changing Market Risks Necessitate an Integrated Analytical Approach

We are prepared to leverage the GMM to assess the challenges and opportunities your company faces in this quickly evolving market. Learn more in on-demand webinar: 3 Factors that Will Guide the Way Forward for Natural Gas, which covers the summary of major issues in our second quarter Base Case. Follow The Spark or subscribe to the ICF Energy Digest for additional summaries of our Base Case forecast, as well as other key topics facing the industry today.